Insurance Agency In Jefferson Ga Fundamentals Explained

Table of ContentsInsurance Agency In Jefferson Ga for DummiesExcitement About Auto Insurance Agent In Jefferson Ga3 Simple Techniques For Home Insurance Agent In Jefferson GaLife Insurance Agent In Jefferson Ga Fundamentals Explained

, the ordinary yearly price for a vehicle insurance plan in the United States in 2016 was $935. Insurance coverage additionally helps you prevent the decline of your lorry.The insurance policy safeguards you and helps you with cases that others make against you in crashes. The NCB may be provided as a price cut on the costs, making auto insurance policy more economical (Life Insurance Agent in Jefferson GA).

A number of variables influence the prices: Age of the vehicle: Oftentimes, an older lorry expenses less to insure compared to a more recent one. New vehicles have a greater market price, so they cost more to fix or change. Parts are less complicated to find for older lorries if fixings are required. Make and design of lorry: Some vehicles cost even more to insure than others.

Risk of burglary. Particular automobiles regularly make the regularly stolen lists, so you may need to pay a higher premium if you have one of these. When it pertains to cars and truck insurance policy, the 3 primary kinds of plans are liability, collision, and thorough. Obligatory obligation coverage spends for damage to another driver's vehicle.

The Insurance Agent In Jefferson Ga Diaries

Some states call for motorists to lug this insurance coverage (https://www.4shared.com/u/IaFm96Zy/jonportillo30549.html). Underinsured driver. Comparable to without insurance insurance coverage, this plan covers problems or injuries you suffer from a motorist that doesn't lug sufficient protection. Bike coverage: This is a policy particularly for bikes since auto insurance doesn't cover motorbike accidents. The benefits of auto insurance coverage far outweigh the threats as you might wind up paying hundreds of dollars out-of-pocket for a crash you create.

It's usually far better to have more coverage than inadequate.

The Social Safety and Supplemental Protection Income handicap programs are the largest of numerous Government programs that offer aid to people with disabilities (Business Insurance Agent in Jefferson GA). While these 2 programs are various in lots of ways, both are administered by the Social Safety Administration and just people that have an impairment and fulfill clinical criteria may receive benefits under either program

A succeeding evaluation of workers' payment claims and the degree to which absenteeism, morale and hiring great workers were issues at these companies reveals the positive results of providing medical insurance. When compared to organizations that did not use health and wellness insurance coverage, it appears that supplying emphasis caused improvements in the capability to hire great employees, decreases in the number of employees' compensation insurance claims and reductions in the degree to which absence and performance were issues for FOCUS organizations.

The Main Principles Of Business Insurance Agent In Jefferson Ga

6 records have been released, including "Care Without Protection: Insufficient, Far Too Late," which finds that working-age Americans without medical insurance are a lot more most likely to obtain inadequate healthcare and obtain it too late, be sicker and pass away faster and receive poorer treatment when they are in the healthcare facility, also for severe situations like a car crash.

The research authors additionally keep in mind that increasing insurance coverage would likely cause a rise in genuine source cost (despite that pays), due to the fact that the uninsured obtain about half as much medical treatment as the independently insured. Wellness Affairs released the study online: "Just How Much Healthcare Do the Without Insurance Use, and Who Spends for It? - Home Insurance Agent in Jefferson GA."

The obligation of supplying insurance for staff members can be a difficult and in some cases pricey job and several small companies assume they can't afford it. What benefits or insurance do you lawfully require to offer?

A Biased View of Insurance Agency In Jefferson Ga

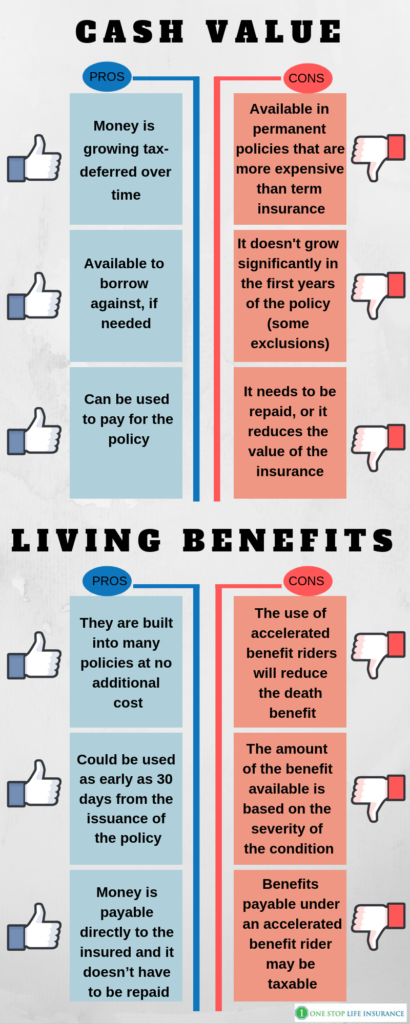

Worker benefits normally begin with health insurance and group term life insurance. As part of the health and wellness insurance coverage package, a company might decide to give both vision and dental insurance.

With the increasing trend wikipedia reference in the cost of medical insurance, it is affordable to ask employees to pay a percentage of the insurance coverage. A lot of companies do place the bulk of the cost on the staff member when they offer access to health insurance. A retired life strategy (such as a 401k, basic strategy, SEP) is typically supplied as a fringe benefit as well - http://www.video-bookmark.com/bookmark/5993400/alfa-insurance---jonathan-portillo-agency/.